CDProjekt bet that most consumers wouldn’t go through the effort of refunding the broken and disappointing Cyberpunk 2077. They were right.

In the company’s recently released financial report for fiscal year 2020, the company touts wild success. It’s not surprising. The COVID-19 pandemic has been a boon for the game industry, with new customers flocking to the medium and existing customers deepening their investment.

CDProjekt’s revenue jumped to 2.1 billion PLN ($563.4 million) four times its 2019 performance. Operating income grew six times to 1.16 billion PLN ($305.6 million). Net profit jumped by more than a factor of six to 1.15 billion PLN ($304 million).

The profit and loss statement paints a picture of a company thriving. But dig a little deeper, and it’s not hard to see the impact of the failed launch of Cyberpunk 2077, a game that has painted a target on CDProjekt’s back.

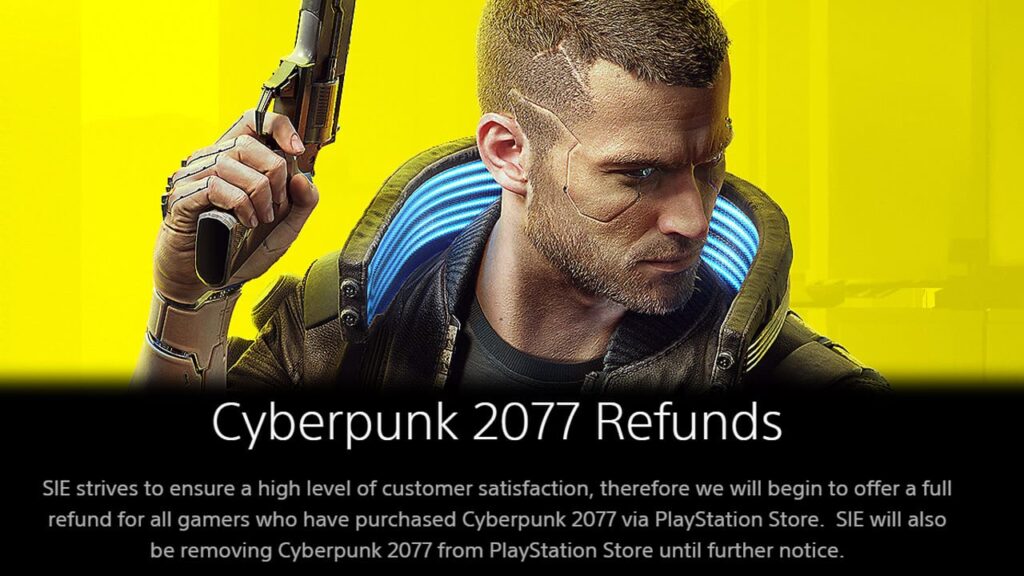

Angry investors have filed lawsuits over deceptive investor communications. The game was removed from the PlayStation Store on December 17, 2020 (ten days after the game’s launch) and has not been reinstated. Platform holders bent their own return policies to accommodate consumers that faced game-breaking bugs, abysmal performance, and an experience that felt unpolished at best and unfinished at worst.

If you exclusively gathered data from social media, you might assume that a significant portion of players were geared up to refund the game. As usual, reality doesn’t align with social media.

In CDProjekt’s earnings report, buried deep on page 40 is a line item about refunds for the “Help Me Refund” program. This initiative was set up to provide recourse for consumers that were denied refunds from Sony, Microsoft, Epic, and Valve (as well as those that purchased at retail and could not get full value from their opened copies).

The Help Me Refund programs payouts to consumers amounted to 8.2 million PLN ($2.17 million). We also know this covered approximately 30,000 units. The Help Me Refund program’s payouts were only 0.385% of CDProjekt total game revenue of 1.94 billion PLN ($563.7 million).

The language here is a bit obtuse. CDProjekt doesn’t go out of its way to make clear what refunds are part of the Help Me Refund program. It’s not until we get to page 73 of the 90-page document that things come a bit more into focus.

There, we find discussion of other consumer returns. These are adjustments to payouts from PC storefronts and console platform holders.

Based on this information, we know that CDProjekt included provisions (funds set aside) for returns in 2020 amounting to 40.5 million PLN ($10.65 million USD). Based on our understanding that the Help Me Refund program covered approximately 30,000 copies of Cyberpunk 2077. We can estimate that the storefront refunds that are accounted for in 2020 represent approximately 147,000 copies.

Of the 13.7 million copies of Cyberpunk 2077 sold, 8 million were pre-ordered.

In other words, 2020 refunds of Cyberpunk 2077 amounted to only 2.2% of pre-orders and 1.29% of total units sold. These are not high refund rates, especially given the high-profile failure of this launch.

Additionally, CDProjekt has provisions for 2021 amounting to 145 million PLN ($38.3 million). The challenge here is that the language is obtuse, possibly intentionally so. What we can glean is that this provision is a conservative carve-out for the following:

- Returns in 2020 that weren’t reflected on December 2020 reporting from storefronts and, therefore, appeared on Q1 2021 revenue statements.

- Reserve pricing for physical retailers that were forced to discount the game below a certain point. Reserve pricing is protection for retailers for instances when goods go unsold and the price must be dropped to move them. The publisher then compensates the retailer with rebates.

- Lost physical sales due to unsold stock that CDProjekt anticipated having to resupply in 2021.

- Lost digital sales due to removal from PlayStation Network.

Because of the language around the long-term provisions and the catch-all nature of the category, it isn’t possible to extrapolate the number of units affected. Additionally, given that this is a provision for the entirety of 2021, we do not yet know how reality will align with CDProjekt’s projections.

However, even if CDProjekt spends (and loses) every dollar of its projection, the bottom line impact of Cyberpunk 2077’s critical flop on the financial statements will be $51.12 million USD against total 2020 video game sales of $563.7 million. It’s not insignificant, but it also is something CDProjekt can recover from, especially if they play things right around the launch of Xbox Series X|S and PlayStation 5 upgrades and turn around their cultural problems (as we discussed in our earlier analysis).

The financial statements don’t tell the whole story, though. If they did, the earnings per share jump from 1.82 PLN ($0.48) to 11.97 PLN ($3.16) would thrill investors.

CDProjekt had lofty goals for Cyberpunk 2077, with what sounded like a GTA Online style multiplayer game and a long, healthy tail with pricing closer to MSRP for months to come. The failure has muted the game’s long-term potential.

Investors aren’t happy, and many of them are bailing out of CDProjekt. Two weeks before Cyberpunk 2077 launched, CDProjekt’s share price jumped to 443 PLN ($117). It currently sits at under 175 PLN ($46.22) a drop of60.5%. The company’s market capitalization has fallen by 27.1 billion PLN ($7.2 billion).

This is the lowest the share price has been since January 2019. Cyberpunk 2077 eroded more than a year’s worth of growth in the snap of a finger. Clearly investors have lost faith.

But what about the public? Any publisher will have its rabid fans that work to shout down any criticism. Cyberpunk’s frothing devotees were an extreme example of that, relentlessly harassing journalists and critics as CDProjekt stood by and let it happen.

The studio lied to the press, promising there would be no crunch on Cyberpunk 2077 (there was quite a lot of it). They threw developers under the bus with investors (and then hastily apologized out of the other side of their mouths). Studio leadership published misleading video footage of Cyberpunk 2077 on consoles while telling investors that the game was in good shape on those platforms (it was really a mess).

CDProjekt and its CDProjekt Red studio especially have lost one of the most precious resources: goodwill. Any consumer that rushes to pre-order the next CDProjekt game is taking unnecessary risk. And, since pre-orders and pre-sales continue to be massive predictors of success, investors are right to see huge risk in CDProjekt until the company can prove it has fixed its leadership problems.

CDProjekt is a reminder that you are only as good as your last performance. Cyberpunk 2077 was booed off the stage. And while the curtain might not be closing on CDProjekt Red, the script needs to be rewritten and the cast shaken up before investors and consumers will buy a ticket for the next show.

Thanks to Kyle Orland of Ars Technica who identified the provisions on page 73 of the earnings report and with whom I had an extensive conversation to puzzle out the language.

Great analysis!

Just a quick note – there seems to be a math typo: the drop in share price from 443->175 is actually 60.5% (not 39.5%).

Thank you! I know exactly how I messed that up, too. I did 175/447 instead of the difference in prices divided by the original price. Appreciate you catching that. I updated to correct. Many thanks!

Great work again Mike!

It’s pretty disheartening to see a company make bank on deception and lies but both the long-term perception and investor faith have taken a big hit. We can only hope this will make CDPR to improve themselves in a multitude of ways going forward, but then again $563.4M revenue (WOW) can easily make them shrug and say they did things right as well.